Why We Launched the Fund

ALGONQUIN DEBT STRATEGIES FUND

Why We Launched the Fund

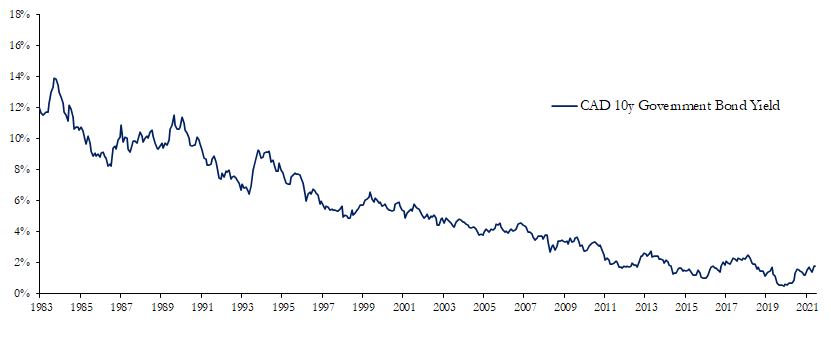

For over 40 years Canadian interest rates have been declining. While investors have enjoyed the ride down, the new rate environment presents new challenges:

- With interest rates at historic lows, it is increasingly difficult to generate adequate returns.

- A rising interest rate environment could lead to investors incurring material losses.

- Given the risk/reward profile, traditional fixed income is no longer an attractive diversification option.