“Saying is a different thing from doing.”

Michel de Montaigne

First and foremost, our thoughts and sympathies are with the people of Ukraine and their families and friends across the world. We hope for a quick and peaceful resolution to this horrifying situation.

Our parents taught us that actions speak louder than words. That ultimately, we will be judged by what we do, not what we say.

These days markets are preoccupied with the actions and words of political leaders and central bankers. History (and recent events) would suggest that the words of politicians should be taken with a grain of salt. It is their actions that show their true intentions and are of consequence.

This is what intelligence agencies have been warning us about Putin: watch what he does, not what he says.

For central bankers, we would argue that the opposite is true. Over the next few months, what they say matters much more than what they do.

Given the current rates of unemployment, inflation, and growth, we have argued that there is no longer a need for a next-to-zero interest rate policy. Thus far, the Russian invasion of Ukraine does not change this conclusion.

Accordingly, we expect the Federal Reserve to follow the Bank of Canada and begin its hiking cycle later this month. Furthermore, based on their communications, we think it’s reasonable to expect both central banks to begin quantitative tightening in Q2 and deliver a string of hikes until overnight rates are in the vicinity of 1%.

At that point, they might pause to assess the economic impact of higher rates or feel the need to accelerate their program. Based on current yield curves, the market expects the overnight rate to get to around 1.75% over the next year or so. But there are still a lot of questions as to how high central banks need or indeed dare go.

The impetus behind raising rates is to tame inflation by curbing excess demand. The war in Ukraine adds further uncertainty to an already murky macro picture. While the imposed sanctions are inflationary, higher rates do little to reduce the price of oil and wheat. Furthermore, the increase in energy and food costs could divert dollars away from discretionary spending and alleviate the price pressures in other sectors. Given these factors, we believe the central banks will proceed with more caution than originally planned.

Therefore, at each rate meeting; the economic forecasts and press conferences will be far more important for the bond market than the change in the overnight rate. The central bankers have said that hikes are needed to bring inflation down. So those are to be expected in the coming meetings. The question is how many and how fast. And the clues to these riddles will be in their words.

So as a hypocritical mentor tells their pupils, our message to central bank watchers is, ‘do as I say, not as I do.’

The Month of February.

Credit.

The sell-off in investment-grade credit continued unabated and was accelerated with the Russian invasion of Ukraine. With so much uncertainty around interest rates, fixed-income investors have been reluctant to invest and have been selling high-quality, liquid bonds to raise cash.

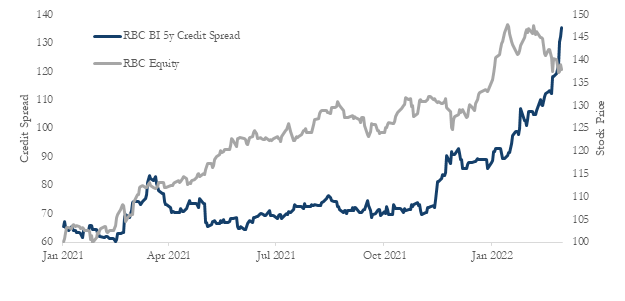

Meanwhile, the equities of these companies have performed well, and their credit fundamentals are improving (e.g. energy). We, therefore, do not view this sell-off as a reflection of increased credit risk, but a technical liquidity-driven event.

The spread on a corporate bond is primarily made up of two components. The risk of default, which is driven by credit fundamentals, and the liquidity premium. Simply put we believe this market is being driven by a sharp increase in liquidity premia rather than a deterioration in credit quality.

As an example of the dislocation, below is a graph of the RBC 5y Credit Spread versus its stock price.

Generic Investment-Grade Credit Spreads:

- Canadian spreads widened 17 bps to 137 bps

- US spreads widened 16 bps to 122 bps

On both a historical and relative basis, investment-grade credit spreads are looking cheap. Could they get cheaper? Sure, but at current prices, the asset class is attractive. While we are not putting all our capital to work, we do think it is time to invest some of it.

Interest Rates.

Sovereign bond yields continued to push higher on expectations of aggressive central bank hikes. Russian aggression has introduced a new variable for central banks to consider, leading to sharp moves as investors readjust expectations. We think the volatility continues until we get some clarity on inflation and growth.

Sovereign yields:

- Canadian 2y finished at 1.44% (+16 bps) and the 10y at 1.81% (+4 bps)

- US 2y finished at 1.43% (+25 bps) and the 10y at 1.78% (+5 bps)

The Funds.

The main driver of returns for both funds has been the sell-off in investment-grade credit. We have been adding exposure into the spread widening and continue to look for opportunities.

In hindsight, we started adding exposure too early, particularly in Canadian banks. But we are not concerned with the credit risks of the issuers and are being patient with our positions. Given current yields, it makes it easier to wait and collect the coupon.

While the move in credit has not been fun, wider spreads have the benefit of higher portfolio yields and strong performance potential going forward.

Algonquin Debt Strategies Fund

| 1M | 3M | 6M | YTD | 1Y | 3Y | 5Y | SI | |

| X Class | -1.86% | -2.67% | -2.24% | -2.63% | -1.03% | 3.73% | 3.90% | 8.49% |

| F Class | -1.91% | -2.80% | -2.51% | -2.72% | -1.61% | 2.95% | 3.14% | NA |

As of February 28th, 2022

The Algonquin Debt Strategies Fund LP was launched on February 2, 2015. Returns are shown on ‘Series 1 X Founder’s Class’ since inception and for ‘Series 1 F Class’ since May 1st, 2016 and are based on NAVs in Canadian dollars as calculated by SGGG Fund Services Inc. net of all fees and expenses. For periods greater than one year, returns are annualized.

Algonquin Fixed Income 2.0

| 1M | 3M | 6M | YTD | 1Y | 2021 | 2020 | |

| F Class | -1.91% | -3.07% | -3.53% | -3.70% | -1.15% | 2.42% | 10.53% |

As of February 28th, 2022

Algonquin Fixed Income 2.0 Fund is an Alternative Mutual Fund and was launched on December 9, 2019. Returns are shown for Class F since inception and are based on NAVs in Canadian dollars as calculated by SGGG Fund Services Inc., net of all fees and expenses. Investors should read the Simpli?ed Prospectus, Annual Information Form, and Fund Facts Documents and consult their registered investment dealer before making an investment decision. Commissions, trailing commissions, management fees, and operating expenses all may be associated with mutual fund investments. An Alternative Mutual Fund is not guaranteed, its value changes frequently and its past performance is not indicative of future performance and may not be repeated. Payment of quarterly distributions is not guaranteed and paid at the discretion of the manager; therefore, it may vary from period to period and does not infer fund performance or rate of return

Looking Ahead.

The Russian aggression against Ukraine and resulting sanctions have led to a high level of confusion. The one thing that we are certain of, is that uncertainty creates opportunity. The divergence between credit and equity markets can not persist for long. Either equity values need to decline, or corporate bond values increase.

The Canadian equity markets seem to be acknowledging the benefits our domestic exporters will have due to reduced competition from Russia. So even with a decrease in global demand, Canadian exporters could do rather well. Meanwhile, the bond market appears to be reeling from rate uncertainty, which has led to a ‘buyer’s strike’ of sorts.

While we don’t know how or when the divergence ends, given the potential for global economic problems, we believe investors will prefer the safety of cheaper assets and the security of corporate bonds.

We have been using lower leverage than normal but have decided to start buying high-quality securities such as senior bank debt. From experience, the shift in psychology from an overabundance of corporate bonds to a drought in supply can occur quite quickly.

We recognize that despite adopting a defensive position, the past few months have been painful for our investors. Absent a default, corporate bonds mature at par, so it makes sense to increase exposure when we think corporate bonds are inexpensive. By doing so, we reduce the time required to recoup losses, but also pave the way for attractive prospective returns.