Fixed Income.

Fixed income 2.0 was launched to help Canadians get better outcomes from their fixed income investments.

Our approach is simple: rather than hunt for excess returns in lower-quality securities, we add more of

the good stuff. In that, we enhance yield and return potential through additional exposure to high-quality, investment-grade credit.

We do so by employing the tools and strategies used by large institutions and banks. The advantage of

these strategies is a greater ability to enhance returns and manage risks.

The result is a product that can offer you more from your fixed income with the security of high-quality,

transparent, and understandable holdings.

Fixed Income 2.0.

1. Target Portfolio Yield: 6 – 8%

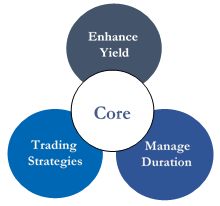

Enhance yield through exposure to investment-grade credit spreads.

2. Proactive Duration Management

The expertise and tools to proactively hedge and manage interest rate exposures.

3. Trading Strategies

Seek excess returns by capitalizing on inefficiencies within bond markets.