“After all is said and done, the greatest publicity agent in the wide world is the ticker.”

Jesse Livermore

Amidst the dreariness and boredom of lockdown life, an army of Reddit traders has captured the public’s imagination. How? By propelling a floundering company’s stock ‘to the moon’ and taking out a few Wall Street titans along the way.

This is the stuff of Michael Lewis’s books and Hollywood movies: David vs Goliath, market manipulation, conspiracy theories, fortunes made and lost over days or hours.

The storylines will vary depending on which echo-chamber you listen to, but at its core, this is a combination of a ‘pump and dump’ and a ‘short-squeeze’.

Or in Ocean’s Eleven con jargon, it’s a Jonathan G. Lebed with a Porsche turbocharge. Which begs the question, who is Jonathan Lebed, and what do he and Porsche have to do with GameStop?

Chapter 1: The Jonathan G. Lebed – The Pump and Dump

‘Pump and dump’ schemes in their classic form follow a simple formula: buy, lie, and sell high.

In the 1920s, Jesse ‘Reminiscences of a Stock Operator’ Livermore would trade a company’s stock between a pool of insiders to give the illusion of volume and a bull run.

In the early 90s, Jordan ‘Wolf of Wall Street’ Belfort employed a boiler room of silver-tongued deception artists to spin stories on penny stocks.

But it was in 1999, that 15-year old Jonathan G. Lebed changed the game by taking it to the interweb. Armed with AOL and E*Trade accounts, he bought overlooked microcaps in hot sectors and then posted recommendations on Yahoo Finance message boards.

He quickly learned that the less professional, more exciting, and more all caps his messages were, the bigger the impact. According to records, on the day he posted a recommendation, the company’s trading volume would soar from 60,000 shares to over a million. In six short months, this high-schooler made nearly $800,000.

As far as the kid was concerned, he was emulating Wall Street analysts and commentators on CNBC. The SEC didn’t see it that way, and Jonathan G. Lebed became the youngest person to be charged with stock manipulation. On September 20, 2000, he agreed to a $285,000 settlement, without admitting or denying the charges.

If pumping up a stock’s price through volumes, sensational rhetoric, and internet message boards sounds familiar, it’s a reminder that history has a habit of rhyming.

But rhymes are similar, not the same. And the biggest difference between the GameStop scheme and the classic ‘pump and dump’ is the transparency.

Rather than employing deception and lies to pump up prices, the WallStreetBets crew took a page out of Porsche’s 2008 playbook – in what has been called the ‘mother of all short-squeezes’.

Chapter 2: The Porsche Turbocharge – The Short-Squeeze

For years Porsche had Volkswagen in its sights as a takeover target. In 2008, CEO Wendelin Wiedeking ramped up the acquisition, declaring his intention to own more than 50% of VW’s voting shares.

This buying created a massive (4x) gap between Volkswagen’s ‘ordinary’ voting shares and its non-voting ‘preference’ shares. While the ordinaries were supported by Porsche’s purchases, the preferences were left to fall with the rest of the 2008 market.

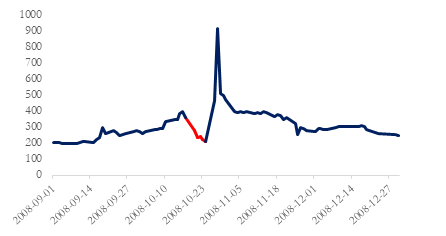

The discrepancy brought in the arbitrageurs, who bought the preference shares and shorted the voting shares. In late-October the ordinaries fell 48%, the arbitrage trade was working, and the short interest grew to over 12% of all outstanding voting shares.

On the afternoon of Sunday, October 26th, Porsche announced that it held 42.6% of the voting shares and another 31.5% in call options for a total position of 74.1%. The Bundesland of Lower Saxony owned 20.1%, leaving less than 6% of shares available on the open market.

It was mathematically impossible for all the short-sellers to buy enough shares to cover their positions. The squeeze was on.

Two days later, the shares were up over 400%, briefly making Volkswagen the world’s most valuable company.

[As a side note for the nerds, Porsche sold some of their shares so the shorts could cover.]

On an ironic note, due in part to the debt incurred from acquiring all that VW stock, Porsche needed a bailout, which it received in July 2009…from Volkswagen. Fahrvergnügen!

Volkswagen AG

Chapter 3: GameStart – History Rhymes

Like the VW situation, it was reported that the short-interest in GameStop exceeded the number of shares available in the open market. The opportunity for a short-squeeze presented itself, but it would require deep pockets to pull-off.

Enter Jonathan Lebed 2020, and a message board with millions of users. The power of social media and call options sent hedge-fund giants scrambling to cover their shorts. GameStop started the year at $17.25, peaked at $483, and as we type, is trading who knows where.

Chapter 4: GameStop – The Long and Short Of it

It’s been a thrilling ride, and for a change, retail investors knowingly participated in the pump. Who knows where this goes in the short-term, but in the end, there’s the inevitable dump. After all, GameStop continues to lose money at a prodigious rate, and unless it can pivot on a dime, this reality will converge with the stock price.

We hate to be the Debbie Downers at the party, but as bond traders, it’s in our nature to worry. And arriving fashionably late to this soiree could prove very costly.

Whether someone calls the cops remains to be seen. Had the party been organized by a small group of colluding investors, they would be behind bars. But perhaps, 8 million Reddit users are just too big to jail.

The Fund.

Being fixed-income nerds, we never get invited to the cool parties nor does anyone want to attend ours. Bonds don’t go ‘to da moon’ and are far too boring for the Reddit crowd. Furthermore, the market structures and access make fixed-income virtually impenetrable to retail attacks. More specifically, our strategy employs short in government bonds, a market that is overseen by the central bank and is far too deep to be manipulated or bullied.

The shenanigans in equities had a minimal impact on bond markets as January was generally a month of credit spreads moving lower and interest rates higher. Through the first half, credit spreads rallied strongly with higher-beta and longer-dated corporates outperforming. The rally was halted just past mid-month, as equities sold off.

The Barclays Canadian Investment Grade index narrowed 7 bps, while the US equivalent widened 1bps. On the rates side, Canadian 30-year yields rose 0.26%.

Domestic new issue supply was light relative to the heavy volumes south of the border. The Canadian deals were concentrated in financials and autos, except for Pembina’s $600mm hybrid deal and Videotron issuing $650mm 10y bonds at 3.125%.

In other credit-related news, the rating agencies are taking a closer look at energy Exploration and Production companies, having put several on negative watch. This is not because anything has changed at the companies, but because agencies have once again moved the goalposts. Our exposure to the E&P sector is minimal, with energy positions focussed on midstream and downstream companies.

The Fund celebrated its 6th birthday this week and for the first time since inception produced a perfect integer return of 1.00%.

| 1M | 3M | 6M | 2021 | 1Y | 3Y | 5Y | SI | |

| X Class | 1.00% | 4.50% | 7.44% | 1.00% | 4.74% | 4.62% | 9.09% | 10.22% |

| F Class | 0.90% | 4.09% | 6.89% | 0.90% | 3.95% | 3.84% | NA | NA |

As of January 29, 2021

The Algonquin Debt Strategies Fund LP was launched on February 2, 2015. Returns are shown on ‘Series 1 X Founder’s Class’ since inception and for ‘Series 1 F Class’ since May 1st, 2016 and are based on NAVs in Canadian dollars as calculated by SGGG Fund Services Inc. net of all fees and expenses. For periods greater than one year, returns are annualized.

Looking Ahead.

Despite hiccups in vaccine distribution and procurement, stricter isolation measures are reducing COVID-19 case counts. With more vaccines being approved, and production capacity expanding, we do expect economic growth to be strong in the latter half of the year. Valuations broadly reflect this optimism, although there are some overlooked gems.

Sovereign bonds, on the other hand, continue to look very expensive. Yields remain near zero, thanks to the central bank’s promise to hold the overnight rate at current levels until the economic expansion is well underway, even if inflation exceeds 2%. Rates are further anchored from the modern version of QE, large scale asset purchase programs.

While central bank policy has a strong impact on short-term rates, this influence declines as one goes further out on the maturity spectrum. As a result, we believe long-maturity yields (10+ years) are biased to move higher.

At present, the downward pressure on longer-term rates is coming from the QE programs and expectations of less government bond supply as borrowing needs decline with stronger economic growth. We expect the BoC to scale back their current pace of buying $4 bn/week sometime in the second quarter.

Rising yields will certainly be a headwind for fixed income investors, however, the potential dislocation can also create opportunities for those who can invest without taking significant rate exposure.

After a lull in new corporate issuance, activity is expected to pick up with borrowers refinancing maturing bonds. The wild card in terms of volumes will be how aggressive companies will be in capital spending or M&A activity. With economic activity poised to rise, we look forward to an increase in debt financing activity.